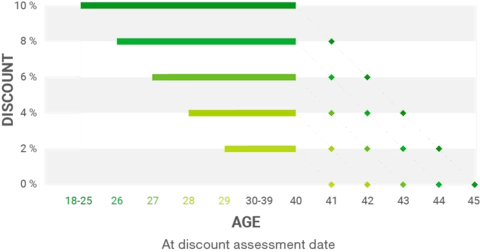

You may be able to get a discount of up to 10% off your private hospital cover if you are aged between 18-29 (known as the age-based discount). This applies to both existing and new members.

This was introduced as part of the private health insurance reforms set out by the Australian Government in 2019 to encourage people to purchase private hospital cover earlier in life. It’s an optional reform, which means other health funds may not have implemented it, or could be applying it to some (but not all) of their covers.

What discount will I get?

When you purchase a Hospital or combined Hospital and Extras cover with us we’ll apply the appropriate discount depending on your age at the time of purchase. As long as you remain on an eligible Hospital cover, you will keep this discount until you turn 41, when it will start reducing at a rate of 2% per year until the total discount has been removed.

Couples and family discounts

When there’s two adults on a health cover (excluding a Dependant Child or Adult Dependant on the policy), the total discount will be an average of your individual age-based discounts. For example, if you’re aged 27 (6% discount) and your partner is 29 years old (2% discount), your discount will average out to 4%.

What if one of us is over 30?

If one of you are over the age of 30, the discount will only apply to the eligible person's proportion of the premium. For example, if you're aged 27 (6% discount) and your partner is 32 (0% discount), a 6% discount will be applied to your proportion of the premium.

Frequently asked questions

Q: Does my discount apply to Hospital and Extras cover?

A: The discount only applies to the Hospital component of your cover.

Q: What is a Discount Assessment Date?

A: The Discount Assessment Date is what we use to determine the discount you’ll receive on your Hospital cover, which is generally either 1 April 2019, or the date you first took out an eligible private hospital cover following 1 April 2019.

Q: I’m already a member - do I get the discount?

A: If you’re an existing member (but not as a dependant on a family cover), between the age of 18-29 and have a chosen Hospital cover you'll automatically receive the discount.

Related

Q: What if I get an aged-based discount but my partner has a lifetime health cover loading (LHC)?

A: Each discount or LHC loading is applied to the relevant person's proportion of the policy for Hospital cover. So in this case, we would split the cost of your Hospital cover in two (because there's two of you!) and apply the discount to one half and the LHC loading to the other half. To make sure we give you an accurate price, it's best if you call us on 13 16 42 to discuss your options.

Q: If I switch health funds, will my age-based discount apply from my previous health fund?

A: Yes, we will recognise any age-based discounts from other health funds. This is known as a ‘retained age-based discount’.

Q: Do I get the discount if I already get the Direct Debit discount?

A: Yes, you are eligible to receive both the age-based discount and a discount for paying by direct debit.

Q: Can international members get the age-based discount?

A: The age-based discount is only available for Australian residents aged between 18-29 years of age.