Why do I need private health insurance?

Private health cover helps fill in the gaps Medicare leaves

Australia is known as ‘the lucky country’ – and it’s no different when it comes to our healthcare. Through Medicare, we can be treated in a public hospital as a public patient for no charge and receive subsidised prescription medicines and GP appointments.

However, Medicare doesn’t cover the cost of everything you might need to continue to be as healthy as possible. That’s where private health insurance comes in; it aims to fill in the gaps that Medicare leaves by helping you fund your healthcare needs. There’s no denying private health insurance can be expensive, but hospital costs can be even more so. Without cover you could be paying out tens of thousands of dollars.

At nib, we consider ourselves your health partner – helping you stay at your healthiest and being there to guide you through the often-confusing health system when you need us. So, we’ve put together a health cover explainer to help you make the right decision for your current circumstances.

First up, what is private health insurance?

Private health insurance is something you can purchase from a registered health insurer like nib. There are three main types of private health insurance, including Hospital cover, Extras cover or a combined cover including both Hospital and Extras cover.

Depending on the level of cover you select, with a private health insurance policy, you may be able to:

Be treated in a public or private hospital as a private patient

Have more choice when it comes to the treatment you receive in a private hospital setting, including where you stay and the doctor who performs your surgery (subject to availability)

Receive a benefit for health services that are not covered by Medicare, including appointments with a physiotherapist, podiatrist or dentist

Be covered in an emergency for ambulance transport

Skip the public hospital waiting list if you find yourself in need of non-emergency surgery

Why do I need Hospital cover?

1. Benefits for your hospital stay

Combined with Medicare, if you’re an Australian resident, your hospital health insurance will help cover the costs associated with your treatment as a private patient. At nib, we have a team of health cover experts on-hand that can help you reduce – or completely remove – any out-of-pockets associated with your hospital stay; so, if you think you might need to go to hospital in the future, it’s best to give us a call on 13 16 42 and discuss your options.

If your chosen level of cover includes your procedure and you attend one of the nib Agreement Hospitals (or any public hospital as a private patient) nib will pay benefits towards:

Hospital accommodation (i.e. your bed and a private room if there's one available)

Operating theatre fees

Intensive care fees

Labour ward fees

Meals

Common treatments and support treatments1

Associated treatment for complications and associated unplanned treatment2

If you’re an nib member, you should always check that your procedure is covered before you go to hospital and contact us, so we can help you keep any extra expenses to a minimum.

Related: Preparing for hospital: What is covered?

2. Save money on emergency ambulance cover

If you’re in an emergency situation with an ambulance on the way, you might be in for the most expensive ride of your life. And, if you’re one of the 30% of Australians who think Medicare will cover the cost, you’re in for a shock.

If you’re not covered by your State Government, most of our covers offer unlimited emergency ambulance cover3 so if you sign up to nib, you’ll get the help you need, when and as often as you need it. Visit Ambulance cover to learn more.

Related: How much does it cost to call an emergency ambulance in my state?

3. Cover in emergencies

While public hospital healthcare (including emergency treatment) is free to all Australian citizens and most permanent residents, lengthy waiting times can apply if you need further treatment after your initial admission. Waiting for treatment has the potential to impact so many aspects of your life, including your ability to work, so avoiding public hospital waiting lists could save you time and money.

With nib’s Accidental Injury Benefit, you'll receive benefits related to the accident in line with our Gold Hospital cover within 90 days after an accident if you seek treatment with a medical practitioner or attend an emergency department within 72 hours of the accident and are admitted to hospital. This includes admission to a private hospital or as a private patient in a public hospital. It’s offered with every level of nib Hospital cover4.

Learn how to quickly and easily check what you're covered for in your member account or via the nib App.

4. Skip the public hospital waiting lists

Without the right cover, wait times for non-emergency treatment in the public system can be weeks and even months. And if you choose to go to a private hospital without the right cover, your treatment won’t come cheap. Taking out Hospital cover helps you avoid the long waiting lists you might experience in a public hospital. Data released by the Australian Institute of Health and Welfare showed that in 2020-21, the proportion of patients waiting more than a year on the elective surgery wait list increased to 7.6%5, with patients requiring a septoplasty (surgery to fix a damaged nose) waiting for a median of 330 days.

With the right level of nib Hospital cover, you choose when and where you get your surgery – meaning you can get back to work (and play) – quicker.

5. Choose your healthcare specialist and where you're treated

By having private health insurance may be able to choose your hospital and treating doctor. This gives you more choice and control, and peace of mind that you're being treated by a doctor of your choosing. Search for a provider in our network using nib's Find a Provider tool.

When should I get private health insurance?

The peace of mind that comes with private health insurance is beneficial at any age, but you might have heard that it’s beneficial to take out a policy before turning 31.

That’s because if you don’t have Hospital cover by 1 July after your 31st birthday, you’ll pay a 2% Lifetime Health Cover loading (LHC) on top of the normal premiums for each year you don’t have Hospital cover up to 70%. The loading applies for 10 years of continuous Hospital cover.

This isn’t just with nib, but every health fund. So, if you wait until you’re 40, you’ll pay 20% more than someone on the same cover who joined when they were 31.

And, that’s not the only reason you might consider taking out health insurance when you’re young. nib members aged between 18-29 can receive discounts of up to 10% of their Hospital cover premium. This age-based discount means that eligible members receive a 2% discount for every year they’re aged under 30, up to a maximum discount of 10% for those of us aged 18-25. The best bit? You’ll keep receiving the discount until you turn 41 (and after that it’ll gradually phase out at a rate of 2% per year).

Check out our page, Discounts for people under 30 for more information.

Will private health insurance save me money?

There’s no denying private health insurance can be expensive, but in some cases it can save you money in the long run.

Reduce your out-of-pocket costs on Extras

Routine dental check-ups, physiotherapy sessions, and optometrist visits can quickly add up. This is where extras cover can be beneficial.

Based on the extras cover level you select, you can receive benefits for a variety of health services not covered by Medicare - such as dental, physiotherapy, and optical treatments - subject to annual limits.

Without extras cover, these expenses would come straight from your pocket. So, if you frequently use these services, extras cover could be a smart way to keep your healthcare costs in check over time.

At nib, we offer a range of Extras covers so you can choose one that’s right for you and your family. There are some core inclusions that we pay benefits towards across most of our Extras policies:

Emergency ambulance6

Preventative dental

General dental

Major dental

Optical

Physiotherapy

We know that everyone is different when it comes to their health, so we also offer a range of Extras covers that can provide cover towards the cost of popular treatments like osteopathy, dietary advice and orthodontia. Find out more in our article What Extras benefits can I get with nib?

Private health cover could save you money at tax time

If your taxable income is above $93,000 ($186,000 for families) and you don’t have an appropriate kind of private health insurance, you may have to pay the Medicare Levy Surcharge. This is an additional 1% to 1.5% in tax on top of the Medicare Levy we all have to pay7.

If eligible, you could avoid the Medicare Levy Surcharge – and pay less tax – by joining any nib Hospital cover and maintaining it for the full financial year. If you take out Hospital cover part-way through the financial year, (if eligible) you will avoid the surcharge for the period you held suitable Hospital cover.

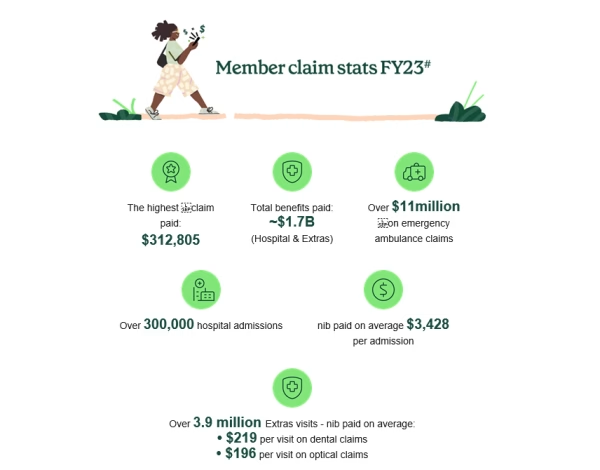

What we covered for our members in FY23#

The increasing cost of healthcare means more reasons to ensure you have Hospital cover with the right level of Extras. Here are some numbers highlighting how much nib covered for our members in FY23.

Interested in becoming an nib member?

At nib, we encourage you to talk to our expert team about selecting a policy that best suits your needs and budget. If you're not sure where to start, contact us – we’re here to help. Alternatively, you can get a quote online in just a few minutes.

1Common treatments include a number of Medical Benefits Schedule (MBS) items commonly used across services covered by your policy. Support treatments means a number of MBS items used to support a principal treatment covered by your policy. Common and support treatments will be covered in line with the level of cover your product provides for the principal treatment. Refer to the nib Policy Booklet for more information.

2Associated treatment for complications means treatment provided during an episode of covered hospital treatment to address a complication that arises during that episode. Associated unplanned treatment means unplanned treatment provided during an episode of covered planned treatment that is, in the view of the medical practitioner providing the unplanned treatment, medically necessary and urgent. Associated treatments will be covered in line with the level of cover your product provides for the principal treatment. Refer to the nib Policy Booklet for more information.

31 day waiting period applies. Not available to: (i) QLD residents who have ambulance services provided by their State ambulance schemes; (ii) TAS residents who are covered under state ambulance schemes in TAS and when travelling in mainland Australia except NSW, SA or QLD; or (iii) pension and health care card holders who have ambulance services provided by State ambulance schemes (check entitlements with Centrelink if unsure); or (iv) DentalPass members.

4Excludes consultations and treatments performed at an Emergency Department. T&Cs apply.

5When compared to 2019-20.

61 day waiting period applies. Not available to: (i) QLD residents who have ambulance services provided by their State ambulance schemes; (ii) TAS residents who are covered under state ambulance schemes in TAS and when travelling in mainland Australia except NSW, SA or QLD; or (iii) pension and health care card holders who have ambulance services provided by State ambulance schemes (check entitlements with Centrelink if unsure).

7Visit the Australian Tax Office for specific rules for calculating income for MLS purposes.

#Figures are general claims statistics taken for the full financial year July 1 2022 – June 30 2023 for nib Health Insurance, including nib Corporate Private Health Insurance, Real Health Insurance, Seniors Health Insurance, GU Health Insurance, Qantas Health Insurance, AAMI Health Insurance, APIA Health Insurance, Suncorp Health Insurance, Priceline Health Insurance, ING Health Insurance.

Why it's important to review your health insurance

Does your health insurance match your needs and lifestyle?

What is extras cover and do I need it?

What exactly is Extras cover and do I even need it?

Switching Health Insurance – What You Need To Know

We answer the biggest questions you have about switching